Understanding Self-Funded Healthcare

Healthcare costs are rising, becoming a major concern for employers and employees. A recent survey shows 63% of employees consider healthcare the most important part of their benefits package. However, traditional healthcare models can be expensive and difficult to navigate.

This is where self-funded healthcare comes in. Self-funded healthcare is becoming increasingly popular among employers and employees, but what exactly is it? This guide will examine self-funded healthcare and how it can benefit both employers and employees.

Wellness Magazine/ Pinterest | 80% of covered workers in larger companies (over 5000 employees) were enrolled in a self-funded health plan in 2020

What Is Self-Funded Healthcare?

Self-funded healthcare, also referred to as self-insured health plans, is a type of healthcare coverage where the employer assumes the financial risk for providing healthcare benefits to its employees.

This means that instead of paying premiums to an insurance company to cover their employees’ healthcare expenses, the employer pays for these expenses directly. Self-funding allows employers to take more control of their healthcare plan and customize it to their specific needs.

How Does It Work?

Self-funded healthcare allows employers to set aside a certain amount for their employees’ healthcare expenses. This money is placed in a fund managed by the employer or a third-party administrator. The fund pays for all medical expenses, including doctor visits, hospitalizations, and prescriptions. Any money left over in the fund at the end of the year can be used to offset future expenses or returned to the employer.

Wellness Magazine/ Pinterest | Self-funding allows cash flow to work to your advantage

Benefits

Self-funded healthcare also has many benefits for employees. One of the biggest benefits is that employees can access a wider network of healthcare providers since self-funded plans are not limited to a specific network. Employees also have more control over their healthcare since the employer can customize the plan to meet their specific needs. This can lead to higher employee satisfaction and better health outcomes.

Risks

While self-funded healthcare has many benefits, there are also some risks involved. One of the biggest risks is that if the employer underestimates their healthcare costs and runs out of money in their fund, they will be responsible for covering the remaining costs.

This is why employers must consider costs and manage funds effectively and carefully. Another risk is that self-funded healthcare is subject to certain regulations varying from state to state.

Wellness Magazine/ Pinterest | One of the main disadvantages of self-funded plans is that they expose the employer to more financial risk and volatility

Bottom Line

Self-funded healthcare is a viable option for employers and employees seeking a more cost-effective and customizable healthcare plan. It offers many benefits, including cost savings, more control over the healthcare plan, and access to a wider network of healthcare providers.

However, it also comes with risks that must be carefully considered and managed. Employers and employees should consult with an experienced healthcare consultant to determine if self-funded healthcare is the right choice for their organization.

More in Treatment

-

`

5 Reasons Why Dad’s Side of the Family Misses Out

Family bonds are intricate and multifaceted, often creating a unique tapestry of connections. However, many people notice a peculiar trend: stronger...

July 12, 2024 -

`

A Quick Guide on How to Get Short-Term Disability Approved for Anxiety and Depression

Living with anxiety or depression poses unique challenges, particularly in the workplace, where stress can exacerbate symptoms. For many, short-term disability...

July 5, 2024 -

`

Why Do People Feel Sleepy After Eating?

Is feeling sleepy after eating a sign of diabetes? Well, not directly. There are many reasons why you feel drowsy after...

June 20, 2024 -

`

What Is High-Functioning Depression? Symptoms and Treatment

High-functioning depression may not be a term you hear every day, but it’s a very real and challenging experience for many....

June 13, 2024 -

`

Kelly Clarkson’s Weight Loss Ozempic Journey – Debunking the Rumors

In a refreshing moment of transparency, Kelly Clarkson, the beloved singer and talk show host, sheds light on her remarkable weight...

June 3, 2024 -

`

What Is the Best Milk for Gut Health and Why?

In recent years, the milk section at the grocery store has expanded far beyond the traditional options. While cow’s milk has...

May 30, 2024 -

`

Do Dental Implants Hurt? Here’s All You Need to Know

When you hear “dental implants,” you might wince at the thought of pain. But do dental implants hurt as much as...

May 24, 2024 -

`

5 Key Differences Between A Psych Ward & A Mental Hospital

Curious about the differences between a psych ward and a mental hospital? You are not alone. With the mental health conversation...

May 16, 2024 -

`

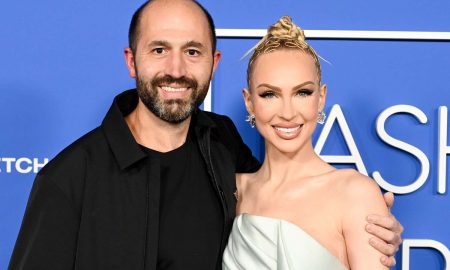

It’s Official! “Selling Sunset’s” Christine Quinn & Husband Christian Dumontet Are Parting Ways

Have you ever found yourself unexpectedly engrossed in the personal lives of celebrities, especially when their stories take dramatic turns? Well,...

May 9, 2024

You must be logged in to post a comment Login