A Quick Guide on How to Get Short-Term Disability Approved for Anxiety and Depression

Living with anxiety or depression poses unique challenges, particularly in the workplace, where stress can exacerbate symptoms. For many, short-term disability emerges as a vital support, offering a financial safety net during periods of intense mental distress. This guide explains how to get short-term disability approved for anxiety and depression, offering a straightforward approach to navigating this complex process.

What Is Short-Term Disability for Mental Health?

Short-term disability insurance acts as a buffer for individuals unable to work due to temporary incapacitation, including mental health struggles like anxiety and depression. This specialized form of insurance acknowledges the profound impact such conditions can have on a person’s work capability, covering a portion of your income while you focus on recovery. The benefits typically extend to cover medical treatments and therapy sessions, mitigating financial worries during your health journey.

Nicola Barts | Pexels | Short-term disability insurance acts as a buffer for individuals unable to work due to temporary incapacitation, including anxiety and depression.

Duration and Scope of Coverage

The length of short-term disability benefits varies, generally spanning a few weeks to several months, with an average period of three to six months. The specific duration depends on your insurance policy details and the recommendations from your healthcare provider. Certain policies might offer extended provisions for mental health, affecting how long you can receive benefits. Understanding these details is crucial to fully leverage the support available to you.

How to Get Short-Term Disability Approved for Anxiety and Depression

Approval for short-term disability due to anxiety and depression hinges on several critical factors. Here’s a step-by-step approach to enhancing your chances of obtaining the necessary support:

Gather Sufficient Medical Evidence

Claims for short-term disability often stumble over inadequate medical evidence. Insurers need comprehensive documentation to validate the severity of your condition and its impact on your work life. To fortify your claim, you should compile:

- A formal diagnosis from a licensed healthcare professional.

- A detailed treatment history, including any medications and therapeutic interventions.

- Statements or reports from mental health specialists such as psychiatrists or therapists.

- Any relevant clinical assessments or test outcomes.

Karolina Kaboompics | Pexels | Insurers need comprehensive documentation to validate the severity of your condition and its impact on your work life.

Meet the Eligibility Criteria

Eligibility for short-term disability requires:

- A clear definition of disability as per your insurance policy.

- A confirmed diagnosis of anxiety or depression by a recognized medical expert.

- Verifiable proof that your mental condition impairs your work performance.

Review your policy meticulously to ensure you understand and meet these criteria before proceeding with your claim.

Adhere to Treatment Plans

Insurance providers often evaluate your commitment to recovery based on your adherence to prescribed treatment plans. Active engagement in therapies and consistent medication intake are viewed as indicators of your effort to manage your condition.

Drazen Zigic | Freepik | Active engagement in therapies is viewed as an effort to manage your condition.

Is Short-Term Disability a Viable Option?

Deciding whether to apply for short-term disability insurance for anxiety and depression depends on personal circumstances and the nature of your condition. While it provides essential financial support and allows you to concentrate on recovery without the stress of work, it does come with limitations. The benefits are temporary and might not fully replace your regular income, potentially straining your financial situation further.

Before applying, consider the advantages and potential limitations of short-term disability coverage. Consulting with healthcare and financial professionals can provide clarity, helping you make an informed decision that best suits your needs and situation.

More in Treatment

-

`

5 Reasons Why Dad’s Side of the Family Misses Out

Family bonds are intricate and multifaceted, often creating a unique tapestry of connections. However, many people notice a peculiar trend: stronger...

July 12, 2024 -

`

Why Do People Feel Sleepy After Eating?

Is feeling sleepy after eating a sign of diabetes? Well, not directly. There are many reasons why you feel drowsy after...

June 20, 2024 -

`

What Is High-Functioning Depression? Symptoms and Treatment

High-functioning depression may not be a term you hear every day, but it’s a very real and challenging experience for many....

June 13, 2024 -

`

Kelly Clarkson’s Weight Loss Ozempic Journey – Debunking the Rumors

In a refreshing moment of transparency, Kelly Clarkson, the beloved singer and talk show host, sheds light on her remarkable weight...

June 3, 2024 -

`

What Is the Best Milk for Gut Health and Why?

In recent years, the milk section at the grocery store has expanded far beyond the traditional options. While cow’s milk has...

May 30, 2024 -

`

Do Dental Implants Hurt? Here’s All You Need to Know

When you hear “dental implants,” you might wince at the thought of pain. But do dental implants hurt as much as...

May 24, 2024 -

`

5 Key Differences Between A Psych Ward & A Mental Hospital

Curious about the differences between a psych ward and a mental hospital? You are not alone. With the mental health conversation...

May 16, 2024 -

`

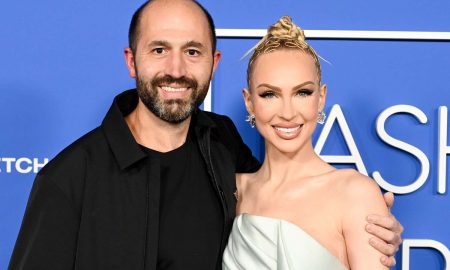

It’s Official! “Selling Sunset’s” Christine Quinn & Husband Christian Dumontet Are Parting Ways

Have you ever found yourself unexpectedly engrossed in the personal lives of celebrities, especially when their stories take dramatic turns? Well,...

May 9, 2024 -

`

What is Premarital Counseling and Why Consider It?

Congratulations! You’ve set a date, picked out your dream dress, and booked the perfect venue. But amidst the whirlwind of wedding...

April 30, 2024

You must be logged in to post a comment Login