Medical Debt: What to Do When You Can’t Pay

Facing medical debt can be a complicated and overwhelming experience; when money is already tight, it can feel like an added stress you cannot bear. However, there are ways to handle medical debt and ensure you still take care of your bills without tensioning yourself too much in the process.

Here are various options for getting control of medical debt so you can move forward with a clearer financial picture. With our advice, paying off your medical expenses does not have to be as daunting as it first seems.

Imed Bouchrika/ Getty Images | Medical debt is a widespread problem in the United States

Understand Your Medical Debt

Medical debt can be overwhelming and confusing, but understanding what type of debt you have and who it is owed to is an important step toward finding a solution. Whether it’s a hospital stay, a visit to a specialist or a medical procedure, medical debt can quickly add up and impact your financial stability.

It’s necessary to determine whether the debt is from a medical provider or a collection agency and whether it’s secured or unsecured. Once you understand your medical debt better, you can explore options such as negotiating payment plans or seeking financial assistance.

Research Your Options

Many hospitals and doctors offer payment plans that can help make the cost more manageable over time. It doesn’t hurt to speak directly with the hospital or doctor about possibly negotiating a lower amount. You may be surprised at the level of flexibility they have in accommodating your financial situation.

PhotoAlto/ Frederic Cirou/ Getty Images | Medical bills can be managed with proper planning and communication

It can feel overwhelming to deal with the financial side of healthcare, but taking the time to research and ask questions can make a big difference in finding a solution that works for you.

Set a Budget

Managing medical debts can be a daunting task, but careful planning can make a world of difference. Setting a realistic budget that covers your medical expenses and allows you to save for unexpected costs is important. Take stock of your monthly income and expenses and look for areas where you can cut back and save some extra money.

This may mean skipping out on that daily coffee or meal delivery service, but it can add up in the long run. By setting a budget and sticking to it, you are taking control of your finances and paving the way for a healthy financial future.

Imed Bouchrika/ Getty Images | More than 60 percent of Americans deplete their savings to pay off medical debt

Reach Out for Assistance

Medical debt can be a heavy burden for anyone to bear. But you don’t have to handle it alone. There are ways to reach out for assistance and get relief from medical debt. One option is charity care programs offered by hospitals or clinics, which can help reduce or eliminate medical bills for patients who meet specific income requirements.

Another option is to seek help from family and friends, who may be willing to offer financial assistance through loans or gifts. Whatever option you choose, don’t be afraid to ask for help when you need it.

More in Treatment

-

`

5 Reasons Why Dad’s Side of the Family Misses Out

Family bonds are intricate and multifaceted, often creating a unique tapestry of connections. However, many people notice a peculiar trend: stronger...

July 12, 2024 -

`

A Quick Guide on How to Get Short-Term Disability Approved for Anxiety and Depression

Living with anxiety or depression poses unique challenges, particularly in the workplace, where stress can exacerbate symptoms. For many, short-term disability...

July 5, 2024 -

`

Why Do People Feel Sleepy After Eating?

Is feeling sleepy after eating a sign of diabetes? Well, not directly. There are many reasons why you feel drowsy after...

June 20, 2024 -

`

What Is High-Functioning Depression? Symptoms and Treatment

High-functioning depression may not be a term you hear every day, but it’s a very real and challenging experience for many....

June 13, 2024 -

`

Kelly Clarkson’s Weight Loss Ozempic Journey – Debunking the Rumors

In a refreshing moment of transparency, Kelly Clarkson, the beloved singer and talk show host, sheds light on her remarkable weight...

June 3, 2024 -

`

What Is the Best Milk for Gut Health and Why?

In recent years, the milk section at the grocery store has expanded far beyond the traditional options. While cow’s milk has...

May 30, 2024 -

`

Do Dental Implants Hurt? Here’s All You Need to Know

When you hear “dental implants,” you might wince at the thought of pain. But do dental implants hurt as much as...

May 24, 2024 -

`

5 Key Differences Between A Psych Ward & A Mental Hospital

Curious about the differences between a psych ward and a mental hospital? You are not alone. With the mental health conversation...

May 16, 2024 -

`

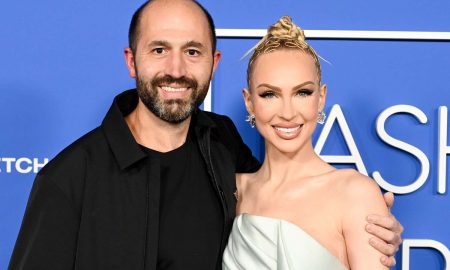

It’s Official! “Selling Sunset’s” Christine Quinn & Husband Christian Dumontet Are Parting Ways

Have you ever found yourself unexpectedly engrossed in the personal lives of celebrities, especially when their stories take dramatic turns? Well,...

May 9, 2024

You must be logged in to post a comment Login