Should You Talk To A Financial Therapist Today?

Consulting a financial planning advisor is pretty normal when you face issues in the fields of investments, retirement planning, and debt consolidation. But, you do have an emotional relationship with your finances, don’t you? Well, that needs to be addressed, and hence, you need someone more knowledgeable and sagacious than just a financial planning advisor. This is a situation where a financial therapist comes into play. Since the rise of financial therapists in 2010, many people have found actionable tips from certified financial therapists and complete peace of mind. Find out when and why you should consult a financial therapist.

Is Money Management A Major Headache For You?

Are you often anxious about how to properly handle your finances? Is making financial decisions becoming increasingly difficult for you? Have you ever given a positive attempt to save money but have fallen flat on your face every time? Are you ruining your financial objectives with your own hands? Is changing your financial habits turning out to be a tough task for you? If the answer to each and every question is yes, then it’s time you must consult a financial therapist. Financial therapy is quite identical to mental therapy as it is designed to help you get on the right path and feel better. The therapy is designed to help people get rid of the stress and emotional turbulence that comes with money management.

Are you often anxious about how to properly handle your finances? Is making financial decisions becoming increasingly difficult for you? Have you ever given a positive attempt to save money but have fallen flat on your face every time? Are you ruining your financial objectives with your own hands? Is changing your financial habits turning out to be a tough task for you? If the answer to each and every question is yes, then it’s time you must consult a financial therapist. Financial therapy is quite identical to mental therapy as it is designed to help you get on the right path and feel better. The therapy is designed to help people get rid of the stress and emotional turbulence that comes with money management.

What Does A Financial Therapist Typically Do?

Before you visit a financial therapist, you must remember that a financial therapist doesn’t provide suggestions on which budget would be appropriate for you or which stocks you must choose. At best, they might recommend a financial consultant who can lend a helping hand on that front — nothing more than that. The main job of a financial therapist is to ask you certain questions that will make you think and look at a particular situation from a different angle. A financial therapist can inquire what financial objectives you have set for yourself, your previous financial failures, or what your parents have taught you in terms of handling your finances.

Before you visit a financial therapist, you must remember that a financial therapist doesn’t provide suggestions on which budget would be appropriate for you or which stocks you must choose. At best, they might recommend a financial consultant who can lend a helping hand on that front — nothing more than that. The main job of a financial therapist is to ask you certain questions that will make you think and look at a particular situation from a different angle. A financial therapist can inquire what financial objectives you have set for yourself, your previous financial failures, or what your parents have taught you in terms of handling your finances.

They Can Help You Deal With Negative Monetary Emotions

Aside from that, you might as well have to go through a word association test that concerns money. By discussing things and sharing your problems, it becomes a lot easier for you to realize the effects of negative monetary emotions and the mental turmoil that you have been undergoing as far as your connection with your money is concerned. You might find out solutions on how to tackle each and every financial hurdle that can cross your way. Normally, your way of dealing with problems depends on your psychology. Financial therapists offer you the techniques and a few practical methods that help you bring around a change in your habits. If you have a tough time saving your money, they offer you motivating factors like how excellent you were or remind you how fantastic you felt the last time when you were successful in that aspect.

Find A Certified Professional First

In case you feel a sense of guilt when you spend money for your personal needs, a financial therapist might come up with a system that can positively help you take care of yourself. All these might inspire you to drop in for a consultation with a financial therapist. But before you do so, you must search for a professional who has the requisite certification. There exist certain universities that offer study programs in financial therapy. A majority of financial therapists possess psychology or counseling degrees along with financial training. You can surf through the directory of the Financial Therapy Association that’s available online.

We all are emotionally and mentally attached to our money. However, while many realize that relationship, some don’t. This is the reason why they find themselves in the quagmire of financial troubles and are often at their wit’s end on how to solve their monetary issues. Mishandling of money and inability to save for the future can bring in dark days. As discussed earlier, a financial therapist can act like your best friend who helps you identify the emotional connection you have with your finances and trains you psychologically. This way, you would be able to explore new depths of financial handling.

More in Mental Health

-

`

5 Reasons Why Dad’s Side of the Family Misses Out

Family bonds are intricate and multifaceted, often creating a unique tapestry of connections. However, many people notice a peculiar trend: stronger...

July 12, 2024 -

`

A Quick Guide on How to Get Short-Term Disability Approved for Anxiety and Depression

Living with anxiety or depression poses unique challenges, particularly in the workplace, where stress can exacerbate symptoms. For many, short-term disability...

July 5, 2024 -

`

Why Do People Feel Sleepy After Eating?

Is feeling sleepy after eating a sign of diabetes? Well, not directly. There are many reasons why you feel drowsy after...

June 20, 2024 -

`

What Is High-Functioning Depression? Symptoms and Treatment

High-functioning depression may not be a term you hear every day, but it’s a very real and challenging experience for many....

June 13, 2024 -

`

Kelly Clarkson’s Weight Loss Ozempic Journey – Debunking the Rumors

In a refreshing moment of transparency, Kelly Clarkson, the beloved singer and talk show host, sheds light on her remarkable weight...

June 3, 2024 -

`

What Is the Best Milk for Gut Health and Why?

In recent years, the milk section at the grocery store has expanded far beyond the traditional options. While cow’s milk has...

May 30, 2024 -

`

Do Dental Implants Hurt? Here’s All You Need to Know

When you hear “dental implants,” you might wince at the thought of pain. But do dental implants hurt as much as...

May 24, 2024 -

`

5 Key Differences Between A Psych Ward & A Mental Hospital

Curious about the differences between a psych ward and a mental hospital? You are not alone. With the mental health conversation...

May 16, 2024 -

`

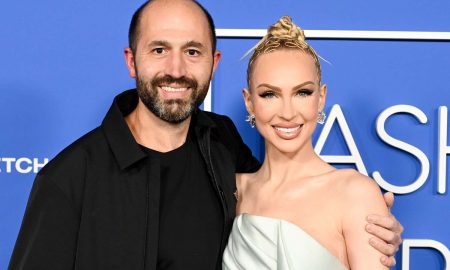

It’s Official! “Selling Sunset’s” Christine Quinn & Husband Christian Dumontet Are Parting Ways

Have you ever found yourself unexpectedly engrossed in the personal lives of celebrities, especially when their stories take dramatic turns? Well,...

May 9, 2024

You must be logged in to post a comment Login