Key Factors That You Need To Consider Before Remarrying

When you decide to remarry, you know you would be combining or sharing your house with your new life partner and also merging your bank accounts. In case you have kids, you might be even more stressed as money matters can get even more complex in such situations. For example, you might have to consider child support payments or find out if remarrying would have an effect on your kid’s inheritance.

Taking this factor into account, explore and analyze past financial issues that you might have had, along with your partner. Keep in mind that if you can straighten out money matters and talk about uncomfortable things before tying the knot, it will be easier for you, your partner, and your ex to avoid conflicts beforehand. Below are some key factors that you need to consider before remarrying.

You Need To Update Your Budget

New couples, irrespective of whether they are in their first, second, third, or even fourth marriage, must chalk out a budget for their daily spending, monthly expenses, and big purchases such as cars, real estate, or even vacations. You might want to share everything related to your household expenses as well as costs that concern your kids from your previous marriage. In case you need to shell out alimony, discussing that with your new partner is imperative. The period before your remarriage might be a suitable time to consider issues ranging from credit card debt to what plans you have regarding managing credit cards as well as credit card rewards. For example, would you allow your new spouse to be an authorized user on your credit card and vice-versa? Don’t forget discussing the past investments that you might have indulged in and also divulge the details about your retirement accounts.

New couples, irrespective of whether they are in their first, second, third, or even fourth marriage, must chalk out a budget for their daily spending, monthly expenses, and big purchases such as cars, real estate, or even vacations. You might want to share everything related to your household expenses as well as costs that concern your kids from your previous marriage. In case you need to shell out alimony, discussing that with your new partner is imperative. The period before your remarriage might be a suitable time to consider issues ranging from credit card debt to what plans you have regarding managing credit cards as well as credit card rewards. For example, would you allow your new spouse to be an authorized user on your credit card and vice-versa? Don’t forget discussing the past investments that you might have indulged in and also divulge the details about your retirement accounts.

Don’t Forget Reviewing Your Insurance Plans And Benefits

Several couples often overlook the fact that they need to update the name of the beneficiaries of their life insurance policies while remarrying. This might invite a huge problem in the family. Even if you share nice chemistry with your ex, you still might not have the desire of letting your ex get the benefits of your life insurance policy instead of your current partner. Opting for additional coverage, in case you are part of a large family, comes as a natural choice. You might also have to consider other updates regarding your coverage, such as who all are included in your health plan. Aside from that, you may also need to amend the homeowners’ insurance with your partner and kids before you settle down. If you are entitled to the benefits associated with Social Security or Medicaid, you must remember that a remarriage might rob you of your Medicaid eligibility, if your spouse rakes in a higher figure than what’s usually allowed. The benefits attached to Social Security too might get eliminated. Now, that’s something to worry about.

Several couples often overlook the fact that they need to update the name of the beneficiaries of their life insurance policies while remarrying. This might invite a huge problem in the family. Even if you share nice chemistry with your ex, you still might not have the desire of letting your ex get the benefits of your life insurance policy instead of your current partner. Opting for additional coverage, in case you are part of a large family, comes as a natural choice. You might also have to consider other updates regarding your coverage, such as who all are included in your health plan. Aside from that, you may also need to amend the homeowners’ insurance with your partner and kids before you settle down. If you are entitled to the benefits associated with Social Security or Medicaid, you must remember that a remarriage might rob you of your Medicaid eligibility, if your spouse rakes in a higher figure than what’s usually allowed. The benefits attached to Social Security too might get eliminated. Now, that’s something to worry about.

Unveil Your Obligations

If you are receiving or paying out child support, this one automatically becomes an important topic which you need to discuss with the individual whom you are going to marry. Before you settle down in holy matrimony, don’t forget to go through the laws of the state that you reside in. That will inform you how remarrying can child support payments. Though missing out on child support is quite unlikely in such a situation, the courts might pass an order to reduce the payment. Similarly, if an individual shelling out payments for child support is remarrying, he or she must sit down and have a detailed discussion with their partners before their marriage and ensure that they are aware of how much is being paid. Since child support payments form a major part of your budget, nothing related to it should stay hidden from your future partner. Also, this way, the kids know who to turn to in case they need financial support. These things need to be straightened out pretty well.

If you are receiving or paying out child support, this one automatically becomes an important topic which you need to discuss with the individual whom you are going to marry. Before you settle down in holy matrimony, don’t forget to go through the laws of the state that you reside in. That will inform you how remarrying can child support payments. Though missing out on child support is quite unlikely in such a situation, the courts might pass an order to reduce the payment. Similarly, if an individual shelling out payments for child support is remarrying, he or she must sit down and have a detailed discussion with their partners before their marriage and ensure that they are aware of how much is being paid. Since child support payments form a major part of your budget, nothing related to it should stay hidden from your future partner. Also, this way, the kids know who to turn to in case they need financial support. These things need to be straightened out pretty well.

Include Financial Aid

You must know that a remarriage might accentuate a parent’s earnings for the FAFSA. In case a parent happens to be the custodial parent for the federal financial aid, they might be in for a surprise since their new earnings would now comprise the income of their new partner. Willing to discuss principal questions regarding how to save for tuition and college costs can be helpful. If either spouse has a kid from a previous marriage, talking over important topics such as whether each partner will be setting aside a particular sum for those costs or not is mandatory.

If you are remarrying, you must avoid any kind of confusion regarding financial matters that may arise in the future, and maintain a level of transparency in your marital life.

More in Family Counseling

-

`

5 Reasons Why Dad’s Side of the Family Misses Out

Family bonds are intricate and multifaceted, often creating a unique tapestry of connections. However, many people notice a peculiar trend: stronger...

July 12, 2024 -

`

A Quick Guide on How to Get Short-Term Disability Approved for Anxiety and Depression

Living with anxiety or depression poses unique challenges, particularly in the workplace, where stress can exacerbate symptoms. For many, short-term disability...

July 5, 2024 -

`

Why Do People Feel Sleepy After Eating?

Is feeling sleepy after eating a sign of diabetes? Well, not directly. There are many reasons why you feel drowsy after...

June 20, 2024 -

`

What Is High-Functioning Depression? Symptoms and Treatment

High-functioning depression may not be a term you hear every day, but it’s a very real and challenging experience for many....

June 13, 2024 -

`

Kelly Clarkson’s Weight Loss Ozempic Journey – Debunking the Rumors

In a refreshing moment of transparency, Kelly Clarkson, the beloved singer and talk show host, sheds light on her remarkable weight...

June 3, 2024 -

`

What Is the Best Milk for Gut Health and Why?

In recent years, the milk section at the grocery store has expanded far beyond the traditional options. While cow’s milk has...

May 30, 2024 -

`

Do Dental Implants Hurt? Here’s All You Need to Know

When you hear “dental implants,” you might wince at the thought of pain. But do dental implants hurt as much as...

May 24, 2024 -

`

5 Key Differences Between A Psych Ward & A Mental Hospital

Curious about the differences between a psych ward and a mental hospital? You are not alone. With the mental health conversation...

May 16, 2024 -

`

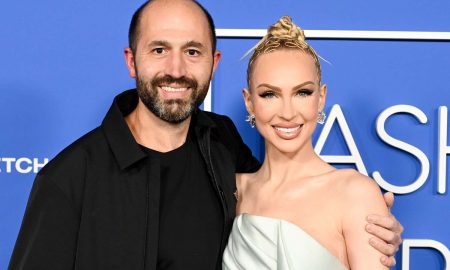

It’s Official! “Selling Sunset’s” Christine Quinn & Husband Christian Dumontet Are Parting Ways

Have you ever found yourself unexpectedly engrossed in the personal lives of celebrities, especially when their stories take dramatic turns? Well,...

May 9, 2024

You must be logged in to post a comment Login